Bitcoin bookkeeping best practice guide

Before Bitcoin transactions can be accounted for, they need to be accurately recorded. Find out more in our guide to best practices in Bitcoin bookkeeping.

Bitcoin bookkeeping: the big picture

When it comes to accounting for digital assets such as Bitcoin, there are challenges from the outset.

On the one hand, all Bitcoin (BTC) transactions are recorded in a decentralized public ledger – the Bitcoin blockchain – that provides a high level of transparency and traceability.

On the other hand, the raw data that exists on the blockchain does not contain enough business information to satisfy audit and accounting requirements (and there would be privacy and security implications if it did).

Operating at scale

Accounting for a limited number of BTC transactions may be manageable enough for a consumer or small business. This could involve manually cross-referencing blockchain records with other financial statements. But a time-consuming system like this is difficult to scale.

The more that businesses rely on manual processes, the more room there is for inconsistencies and human error. So where does that leave businesses that want to integrate Bitcoin into their day-to-day business operations?

This article will examine how typical journal reports from the world of traditional finance (TradFi) differ from a blockchain transaction record, and look at how to “bridge the gap” between the two. We will also cover other important considerations, including what to look for in Bitcoin bookkeeping software.

The key to Bitcoin bookkeeping is bridging the gap between blockchain data and standard accounting ledger systems.

What is the Bitcoin ledger?

Let’s look in more detail at exactly how Bitcoin is recorded.

Each Bitcoin transaction is added to the Bitcoin blockchain, a decentralized public ledger or database that contains the history of every Bitcoin transaction that has ever taken place.

The system is decentralized because it is made up of thousands of nodes, which work via consensus to validate transactions and add them to the blockchain.

In Bitcoin, there is no system of accounts and balances. Units of Bitcoin (which on a technical level are referred to as UTXOs) are exchanged on a peer-to-peer basis.

The Bitcoin blockchain is updated in real time to reflect the changing ownership of the total amount of Bitcoin in existence. This includes new Bitcoins as they are mined and added to the blockchain.

Finding a Bitcoin transaction online

The transparent nature of the blockchain means that any individual transaction can be located on the blockchain.

One way that transactions can be tracked is via block explorers. A block explorer is a website that aggregates all the raw data from the blockchain in a user-friendly, searchable database.

How to read a Bitcoin transaction record

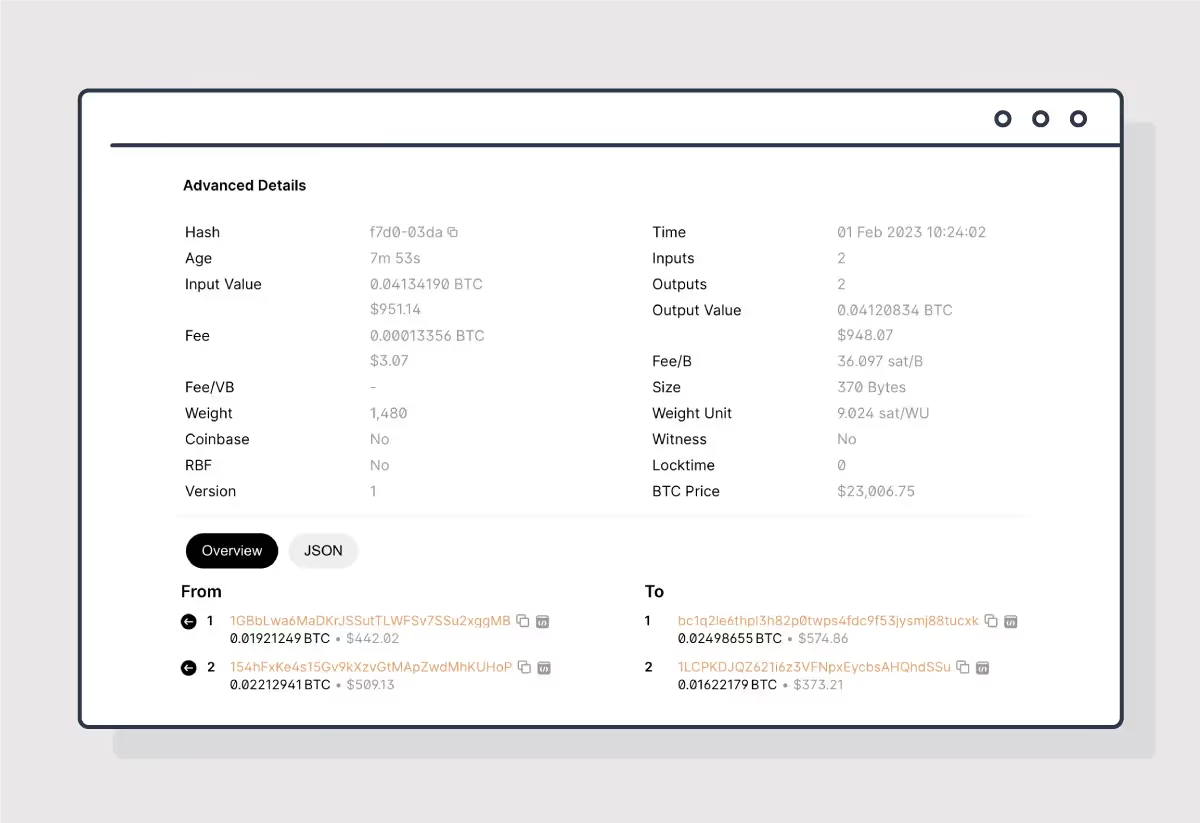

Let’s take a random example of a real BTC transaction on a block explorer and look at some of the information it contains.

Source: blockchain.com

Hash: The unique identifier of the transaction. The hash can be entered in any block explorer to locate the transaction and check its status.

Age: How much time has elapsed since the transaction was broadcast to the blockchain.

Inputs: We can see that there are two different inputs (UTXOs) which together make up the amount broadcast in the transaction, less the fee (which is also shown).

Outputs: It is common for a Bitcoin transaction to include more than one output. That’s because spending more than one UTXO and generating “change” that gets returned to the sender is a key part of how UTXOs work in Bitcoin.

Other information includes:

- A timestamp of when the transaction was broadcast

- Its size in bytes (the more inputs/UTXOs, the larger the size)

- The price of BTC in USD at the time the transaction took place.

-

Introduction to Bitcoin journal reports

As we have seen, Bitcoin is not a system that uses accounts and balances. But TradFi does.

In bookkeeping, a journal report is a summary of transactions that have taken place in a specific timeframe. Journal reports are used to supply the raw data for the general ledger, the principal book of accounts when it comes to a company’s finances.

Journal reports are typically a chronological record of transactions. They may represent a particular department, business function, or geographic region.

Thanks to advances in accounting software technology, journal reports are increasingly auto generated, removing the risk of human error, and streamlining financial reporting.

A journal report is typically formatted as a spreadsheet with multiple columns for standard data such as transaction date, reference, category of payment, debit/credit, and net balance for the account in question.

Businesses that work to widely recognized accounting standards (such as GAAP in the United States or IFRS in many other countries) will likely need to reconcile raw blockchain data with the rest of their accounts in the form of journal reports.

This is in order to:

- Provide the raw data needed for the general ledger, for purposes such as preparing financial statements, taxation, and audit.

- Import into existing TMS (treasury management system) and ERP (enterprise resource planner) software, such as Oracle Netsuite, in a format compatible with those systems.

A Bitcoin journal report should contain as much information as possible about the business function of a Bitcoin transaction as well as its blockchain data.

This includes:

- Showing whether a transaction is internal or external, an essential requirement for audit purposes.

- Itemizing fees as separate journal entries for simplified reporting and analytics

- Including internal references such as payment category or type

- The debits and credits to the relevant accounts

- Indicating who created and approved the transaction.

In order to compile all this information, companies may choose to operate multiple different spreadsheets, and manually update these to include blockchain data alongside TradFi bookkeeping information.

As mentioned above, this can be both time-consuming and prone to human error.

An easier option is to use a specific Bitcoin treasury operations platform to create automated journal reports and perform other bookkeeping functions.

To find out more, read our article What does a Bitcoin journal entry look like?

What to look for in Bitcoin bookkeeping software

In addition to the journal report functionality outlined above, Bitcoin bookkeeping software should help organizations to fulfil other essential reporting tasks. Features to look out for include:

Cost basis tracking: Does the system record cost basis in a granular way to easily allow for fair value measurement of Bitcoin holdings and accounting methods such as FIFO (first in, first out)?

Invoice management tools: Can accounts payable/accounts receiveable personnel track and report on payment flows without time-consuming manual tasks? Is reconciliation a smooth and integrated process?

Dashboards and reports: Is it possible to see balance updates, total unconfirmed transactions and other key metrics at a glance? Is the value shown in both Bitcoin and fiat currency?

Audit and compliance workflows: Is the system compatible with standard compliance frameworks such as SOX, mirroring organizational internal controls and recording data such as transaction creation and approval in a detailed manner?

Bitcoin treasury operations with Fortris

Platforms such as Fortris create a bridge between the world of digital assets and TradFi, allowing companies to hold and use digital assets without the need to replace their existing back-office systems.

Fortris acts as a data-rich digital asset subledger that’s compatible with existing TMS and ERP platforms. Fortris integrates seamlessly with platforms such as Oracle NetSuite to allow for reporting functions such as trial balances to be carried out with ease.

Furthermore, the user-friendly interface means finance teams can embrace digital asset innovation without the need for specialized knowledge or extensive training.

Fortris handles digital asset treasury operations for enterprise business.

Want to learn more? Book a demo today.

Fortris handles digital asset treasury operations for enterprise business.

Want to learn more? Book a demo today.