Who decides the Bitcoin fee and where does it go?

One of the key differences between digital assets such as Bitcoin and traditional currencies is the cost of making a transaction.

Why is it sometimes much cheaper, and sometimes more expensive to send Bitcoin payments? Who decides the fee, and where does it go? We’ll answer these questions and more in this deep dive into Bitcoin transaction fees.

What are Bitcoin fees?

To understand Bitcoin fees, we first need to know some of the fundamentals of how Bitcoin works.

Unlike traditional currencies (also known as fiat) which are issued by central governments and exchanged via financial instututions such as banks, Bitcoin exists in a decentralized database called a blockchain.

Bitcoin payments don’t work like bank payments

When you make a bank transfer to someone, your bank first checks that you have available funds and then updates its ledger when your money is sent. Your recipient’s bank registers the payment and updates your recipient’s available balance.

The bank’s business model is to make money from your account fees, from transaction fees, or from leveraging the money you deposit with it.

But what about in Bitcoin, when there are no “accounts” and no centralized authority? The answer lies with Bitcoin miners.

What do Bitcoin miners do?

As well as minting new Bitcoin via a process called proof of work, miners are also responsible for validating Bitcoin transactions.

Each time an amount of Bitcoin is used in a transaction, miners check the transaction against the blockchain record to make sure it is valid, then bundle it up with other transactions into a block of data and add it to the ledger.

It’s called a blockchain because it is a “chain” of blocks of data, each one building on the unique data of the block before it.

Both the mining process and the transaction confirmation process are secured by cryptography, which helps make the blockchain resitant to fraud or bad actors.

So, to answer our earlier question, Bitcoin transaction fees – also known as mining fees or network fees – are rewards earned by miners for the work they do to process transactions and add them to the blockchain.

Important note: Bitcoin exchanges, payment platforms and brokerage services may charge a fee for their use of their services. These are separate from miner fees, and are often referred to as ‘platform fees’.

How are Bitcoin fees calculated?

In traditional currency payments, transaction fees are commonly a percentage of the transaction value or a flat fee. But this is not the case in Bitcoin. In fact, the miner fee is decided by whoever creates the transaction.

This is where the law of supply and demand comes in.

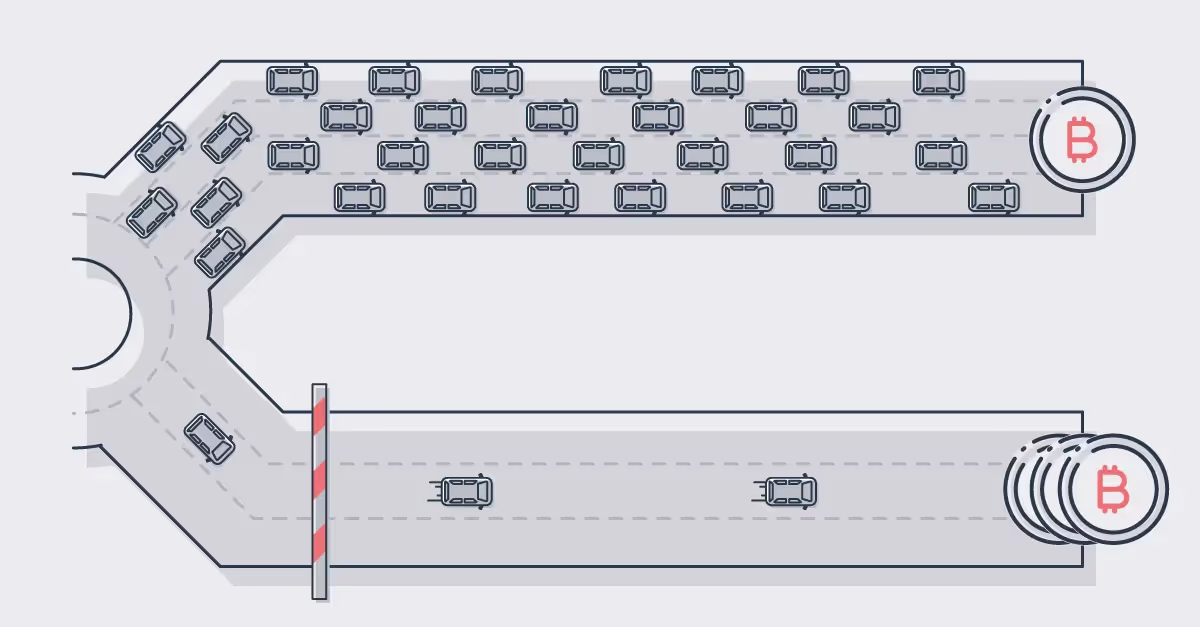

All unconfirmed Bitcoin transaction go into a sort of “waiting room” called the Bitcoin mempool, short for memory pool.

If there are a large number of pending transactions in the mempool, miners are likely to prioritize those that are the most profitable for them.

In other words, the transactions that have a higher fee relative to their transaction size. A small size transaction with the same fee as a large one is more likely to be picked by miners.

The role of UTXOs in transaction size

Without getting too technical about it, individual “chunks” of Bitcoin are called unspent transaction outputs, or UTXOs. You can read about them in more detail in our article on UTXO management.

In short, a UTXO is a packet of data that can have any value. You could have a single UTXO worth the equivalent of a million dollars, or a single UTXO worth just a few cents (or satoshi, as the smallest units of Bitcoin are known).

The key thing to know is that, on the Bitcoin network, the size of the transaction doesn’t correlate to its value.

Furthermore, larger-value UTXOs can only be divided into smaller units of value by “spending” them, ie, using them up in a transaction. This video shows how that works:

Depending on how many different UTXOs they have in their wallet or wallets, a user may need to spend several of them at once to make a payment.

Let’s say you want to send someone a high-value payment but you only have 50 smaller-value UTXOs. Each one of those increases the data size of the transaction.

Because more data means more computing power, transactions that require a large number of UTXOs are less profitable for miners, unless the sender has offered a higher fee rate to offset that.

Therefore, we can conclude that a Bitcoin transaction fee needs to take into account the size of the transaction and also the current market demand. A large transaction size and a busy Bitcoin network is likely to require a higher fee.

Common challenges and solutions

As we have seen, the nature of transferring value via the Bitcoin network is very different to traditional currency. Bitcoin has a number of advantages, such as speed, transparency and resistance to outside interference, but it also presents some challenges when it comes to fee management.

Bitcoin transactions can get stuck

If the Bitcoin network has a large number of transactions pending, and your transaction has a low fee rate associated with it, the transaction may get “stuck”, as miners prioritize more profitable transactions.

This problem can be managed by timing transactions to avoid the times when the network is most congested, but there are also technical solutions.

For example, some Bitcoin wallets have a function called replace-by-fee (RBF). This allows you to replace a low-fee transaction with one that has a higher fee attached.

Even if a Bitcoin transaction isn’t stuck indefinitely, the fee rate could mean the difference between a transaction being added to the blockchain in just a few minutes, or taking several days.

Most Bitcoin wallets let users select a fee priority when creating a transaction. Lower priority transactions can be assigned lower fees, while urgent transactions can be assigned a higher fee priority.

To learn more about factors that can affect transaction times, see our article How long does a Bitcoin transaction take?

Small-value payments may be expensive

As we have seen, Bitcoin fees aren’t related to the value of the transaction, but rather the data size and the fee priority assigned to it by the sender. This means that a transaction worth hundreds of thousands of dollars could cost the equivalent of just a few cents to send.

However, the inverse is also true, especially if a small-value transaction is made up of lots of UTXOs. The miner’s fee required to send it may even be greater in value than the transaction itself (especially if it has a high-priority fee rate).

There are a number of strategies to offset this. For example, batching small-value UTXOs together to combine them into larger ones, and sending these transactions when fees on the network are low.

Considerations for enterprise business

For a business processing Bitcoin transactions at scale, fee optimization is of the utmost importance. This is where specialized digital asset enterprise treasury management tools come into their own.

A platform like Fortris gives organizations the ability to manage bulk payments efficiently so that fees are kept as low as possible, through advanced wallet functionality that uses efficient UTXO selection methods based on the transaction amount and market fees.

It's like saving your small change for low-value purchases and keeping your hundred dollar bills for large payments, so you’re not having to pay for large-value items with hundeds of small coins and vice versa.

Along with tools for fee optimization, Fortris is built with a security-first mindset, with robust internal controls and customizable user groups and roles.

Plus, Fortris integrates directly with back-office systems such as Oracle NetSuite for ease of reporting.

Fortris handles digital asset treasury operations for enterprise business.

Want to learn more? Book a demo today.