How long does a Bitcoin transaction take?

Bitcoin users can buy, sell, and trade the digital asset without going through traditional banking institutions.

The peer-to-peer nature of Bitcoin means many consumers and, increasingly, businesses have realized its potential for facilitating fast, cheap, and secure financial settlements.

But the time it takes to settle a Bitcoin transaction can vary depending on a number of factors. To understand these, let's first look at how Bitcoin transactions work.

What happens when a Bitcoin transaction is sent

Bitcoin transactions must be verified on the blockchain, a decentralized database, to ensure legitimacy.

The way this works is that transactions are bundled into "blocks" of data. Once the network has verified the transactions are all legitimate, the block is added to the blockchain. This is known as a confirmation.

Timeline of a Bitcoin transaction

1. The transaction is signed

A Bitcoin holder uses wallet software to send their BTC transactions. The wallet “signs” the transaction and broadcasts the details to the network of nodes that make up the Bitcoin network.

This happens in stages. First, the wallet sends the transaction to the nodes that it is connected to. Those nodes check that the transaction is valid, then send it to the nodes that they are connected to – and so on.

2. The transaction enters the mempool

It’s important to note the difference between verifying a transaction (ie, checking that all the numbers add up and that no one is spending funds they don’t have) and confirming it.

Each node keeps a database of unconfirmed transactions, known as the mempool (memory pool). This is like a waiting room where transactions are stored until the final step in the process.

3. A miner puts the transaction into a block

Mempool transactions are bundled into blocks of up to 3,000 transactions . This work is done by Bitcoin miners, who are ultimately responsible for building the Bitcoin blockchain.

Their incentive comes from the block rewards that they earn (paid in an amount of newly-minted BTC), and from the transaction fees of the transactions included in the block.

These transactions are confirmed, and cleared from the mempool, as new Bitcoin blocks are added.

But how long does this process take?

The average block confirmation time for a Bitcoin transaction is about 10 minutes. This number can vary widely based on the following factors.

What can affect Bitcoin transaction times?

Fees

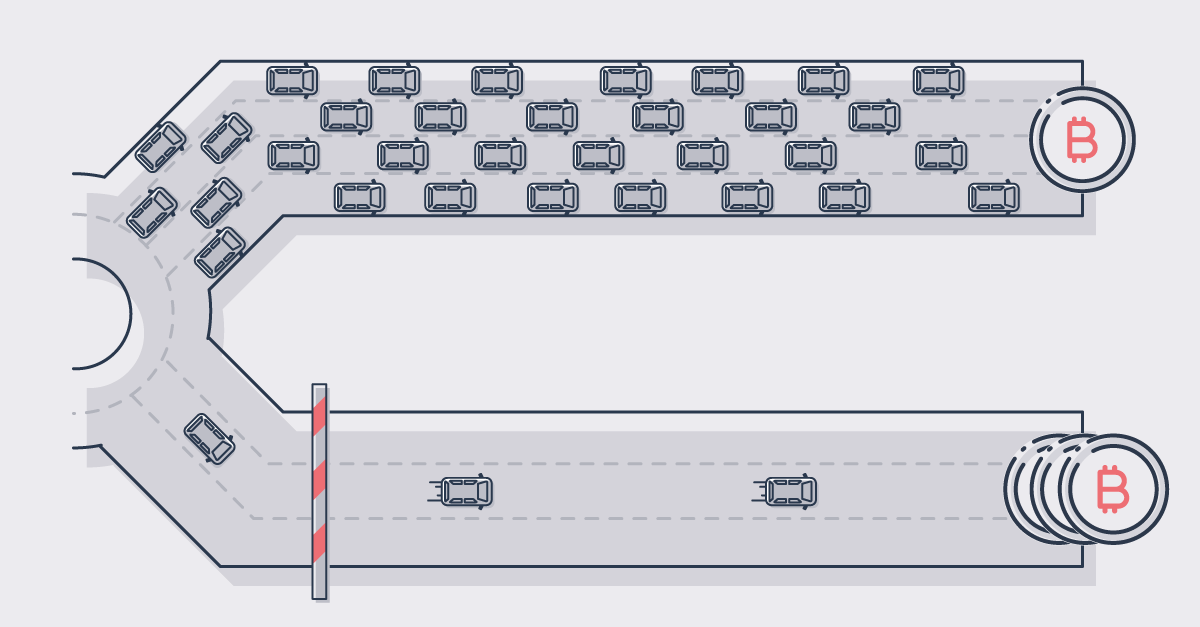

Bitcoin transaction fees are the primary determinant of how long it takes to transfer Bitcoins.

The transaction fee (more accurately called the mining fee) is set by the party who creates the transaction.

Miners will prioritize transactions with higher fees, as it boosts their earnings per block. As a result, paying a higher miner fee can speed up a transaction.

In this way, we can compare paying a higher transaction fee with taking a toll road when a regular road is available.

Low-fee transactions can also be rejected by the mempool or otherwise get stuck and remain pending.

Network congestion

Bitcoin’s scalability limitations also make an impact. The blockchain can only handle up to seven transactions per second.

If many transactions flow into the mempool at the same time, some might need to wait for inclusion in the next block.

Hash rate

The hash rate is another factor. This refers to how much computing power a network is using for transaction processing.

A low hash rate means there’s a lack of miners to work and help confirm transactions. Miners will often refuse to work if they believe the potential rewards are not worth the effort, meaning transactions will take more time to confirm.

Number of confirmations

Another consideration when it comes to the timing of Bitcoin transactions is the number of confirmations required.

As we explained above, Bitcoin transactions are confirmed on the blockchain when the block they are in is created and added to the chain.

These transactions are then re-confirmed as subsequent blocks are created and added, and the chain grows.

This short video demonstrates this process:

Some tools only require one confirmation, but others might require multiple transaction confirmations before a transaction is considered "settled" - ie, the funds are available to spend.

For example, the crypto exchange Binance requires a one-block confirmation for deposits and two for withdrawals. With Coinbase, three confirmations are needed to consider a Bitcoin transaction as "final".

For high-value transactions, and depending on the provider, many more confirmations may be required.

Crypto users should always research how many confirmations a particular platform or tool requires to get a good idea of how long transactions might take.

How to speed up a Bitcoin transaction

Many Bitcoin users wonder how they can expedite their transactions. Raising the transaction fee remains the easiest way to help a transaction settle faster. Miners are incentivized to prioritize transactions with higher fees.

Another strategy is to transact during low-congestion periods. Bitcoin holders can use tools like Blockchain.com’s Explorer to study mempool size charts to understand when the number of unconfirmed transactions is at its lowest.

Some rely on transaction accelerators to optimize speeds. These tools rebroadcast transactions to a vast array of nodes across the world, placing the transaction back into the queue. A few accelerators can even automatically add transactions to the next block.

The big picture: Bitcoin scalability

Slow transaction speeds, especially as Bitcoin becomes more popular, have always been a key issue within the crypto community.

In fact, Bitcoin Cash (a "fork" or spinoff network) emerged due to arguments about how to best scale Bitcoin’s blockchain to boost the number of transactions per second.

Other options include so-called soft forks to Bitcoin’s protocol. In 2017, the community activated SegWit to optimize second-layer scaling solutions.

Another solution comes through secondary Bitcoin layers like the Lightning Network.

Lightning allows users to make up to hundreds of thousands of cheap transactions each second while still benefiting from Bitcoin’s blockchain security.

Learn more about Lightning Network in this talk by Fortris Innovation Manager, Antonio Tovar:

Fortris handles digital asset treasury operations for enterprise business.

Want to learn more? Book a demo today.